Table of Content

Traditional financial analysis often falls short when dealing with large, complex datasets and dynamic market conditions. It tends to rely heavily on historical data and static models, limiting its ability to predict future trends accurately.

As a result, businesses often face challenges in making informed decisions due to outdated or incomplete insights.

But this is changing rapidly and how.

Artificial Intelligence (AI) is set to be the key source of transformation, disruption, and competitive advantage in today’s global economy. A PwC study revealed that AI could contribute up to $15.7 trillion by 2030, with $6.6 trillion coming from increased productivity alone.

What’s more—businesses that integrate AI-driven models in their operations are seeing up to a 40% improvement in forecasting accuracy compared to traditional methods.

This holds specifically true for SMEs and fintech companies. In this blog post, we’ll study six critical uses where AI-driven financial modeling and forecasting are making waves and how such businesses can leverage that.

Let’s get started.

What Is AI-Driven Financial Modeling and Forecasting?

It uses Machine Learning (ML), Deep Learning, and Natural Language Processing (NLP) to analyze large datasets, automate complex calculations, and enhance decision-making.

These technologies improve forecasting accuracy, identify hidden patterns, and provide deeper insights into market trends, risk factors, and opportunities.

By continuously updating models with real-time data, AI enables businesses to optimize financial strategies, manage systemic risks more effectively, and stay competitive in dynamic markets.

Maximize ROI with AI-Driven Financial Data Analysis and Forecasts!

Schedule Free Consultation6 Use Cases of AI-Driven Financial Modeling and Forecasting (+ Examples)

1. Real-time data analysis capabilities and financial planning

SMEs and fintech companies must process vast amounts of market data in real-time to stay competitive. Traditional financial models often struggle to handle the influx of new information, especially when decisions must be made quickly.

Financial forecasting systems, however, excel at processing massive data streams. They can simultaneously analyze data from financial markets, news reports, and social media to identify emerging trends or shifts in investor sentiment.

This empowers businesses to adjust their financial plans dynamically, avoiding potential risks or capitalizing on new opportunities as they arise.

Imagine a mid-sized retail company looking to expand its operations. By integrating an AI-driven financial model, it can monitor market trends in real-time. If the AI detects a sudden increase in raw material prices, the model alerts the business, allowing it to adjust its expansion plans before costs escalate.

2. Automated financial forecasting

Predictive analytics, powered by AI, analyzes historical data and detects patterns. It can make accurate predictions about crucial financial metrics like cash flow, sales, revenue, profit, and even customer churn, enabling businesses to anticipate future performance.

For example, an AI model can undertake cash flow forecasting based on past sales trends, seasonal demand, and current economic conditions. It can predict revenue by analyzing customer behavior, market demand, and competitor activity.

Additionally, AI can identify potential risks, such as predicting when a customer is likely to churn, allowing businesses to act proactively.

For SMEs, AI-powered predictions are a game-changer.

With limited resources, accurate forecasting allows them to make data-driven decisions about their growth strategies.

For example, the AI model might reveal that demand for a specific product will increase during particular seasons or economic cycles, allowing the SME to optimize inventory management and plan targeted marketing efforts.

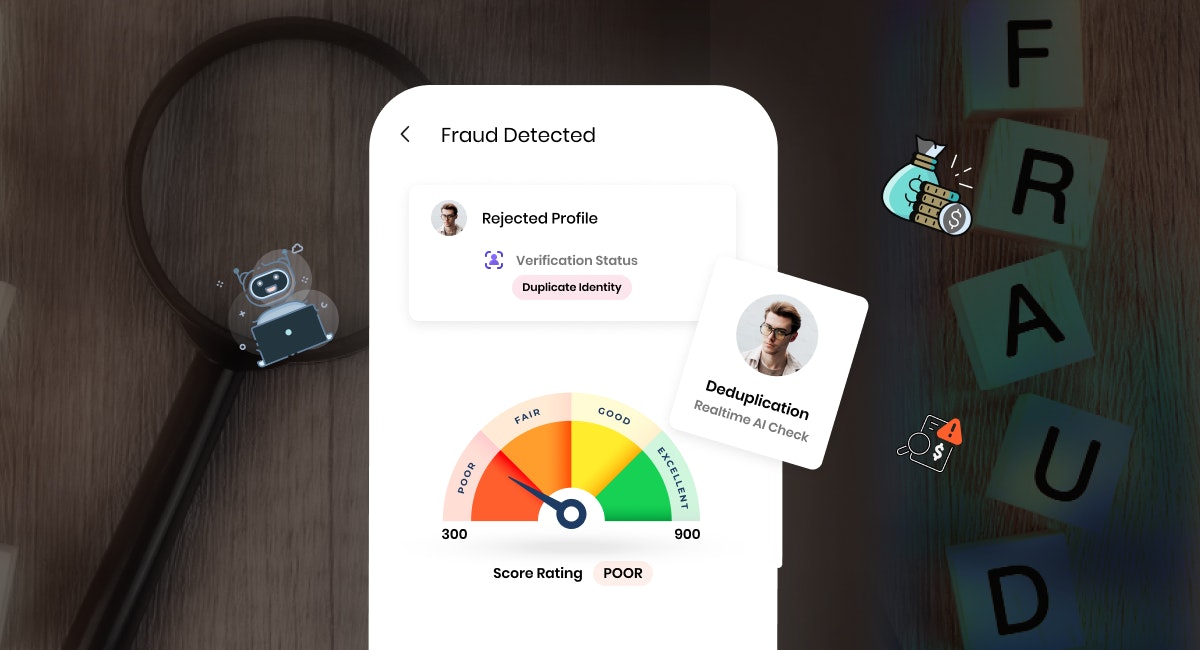

3. Fraud detection and prevention

AI algorithms identify unusual patterns in financial transactions through anomaly detection. By analyzing vast amounts of transactional data, they can learn what constitutes normal behavior and flag any deviations that may indicate fraudulent activity.

One of AI’s significant advantages in fraud detection is its real-time monitoring of transactions. It analyzes each transaction as it occurs, allowing fintech companies to detect and block potential fraud almost instantaneously.

This improves detection rates and reduces false positives—a common problem where legitimate transactions are flagged as suspicious.

For example, AI models can detect irregular purchasing patterns, such as sudden high-value purchases in different geographic locations, flagging them as potentially fraudulent, thereby minimizing credit card fraud.

4. Credit scoring and risk assessment

AI models can analyze a broader range of data, including alternative sources like social media activity, online behavior, payment habits for utilities or rent, and smartphone usage patterns.

They provide a more holistic view of a borrower’s creditworthiness, especially for individuals or SMEs with limited credit history. Additionally, AI models can adapt to changing market conditions or borrower behavior, improving the accuracy of risk profiles over time.

This reduces the likelihood of default and enables more precise interest rate offerings based on an individual’s actual risk rather than relying on generalized models.

For example, a small tech startup with a short operational history but positive social media engagement and growing website traffic may receive favorable loan terms because AI recognizes its growth potential.

5. Portfolio management

AI optimizes asset allocation based on a client’s unique risk-return profile. Analyzing large datasets, including historical market performance, client financial goals, and risk tolerance, can build personalized investment strategies that cater to individual needs.

One key USP of AI in portfolio management is its ability to automatically rebalance portfolios based on changing market conditions.

AI systems continuously monitor the performance of various assets. When market fluctuations occur, they adjust the asset prices and allocation to maintain the desired risk level and meet the client’s objectives.

Consider an AI-powered robo-advisor service used by an individual investor. The AI initially creates a balanced portfolio with 60% stocks and 40% bonds based on the investor’s moderate risk appetite and long-term goals.

As market conditions change—say, with stock volatility increasing—the AI rebalances the portfolio, moving 10% of the stock allocation into bonds to reduce risk exposure.

At the same time, the AI monitors global economic conditions and may even suggest alternative investments like real estate or commodities to diversify the portfolio further.

6. Scenario analysis and stress testing

Traditional scenario analysis often relies on limited data and predefined models. Still, AI can process vast historical and real-time data, enabling it to simulate a wide range of market conditions, such as economic downturns, regulatory changes, or supply chain disruptions.

With these simulations, AI provides valuable insights into how different scenarios could affect cash flow, profit margins, and overall business stability. It can even account for complex, interdependent variables that traditional approaches might overlook.

For example, a fintech company can use AI to simulate the effects of a global recession on its loan portfolio. The AI model can analyze past recession data, current economic indicators, and customer credit profiles to predict how many loans might default under stress.

Based on these findings, the business can adjust its lending policies by tightening credit requirements and increasing liquidity reserves, ensuring it remains solvent during the downturn.

AI in fintech can recommend specific actions—such as adjusting operational budgets, changing investment strategies, or securing additional funding—that would minimize potential financial damage in adverse scenarios for fintech companies.

Benefits of AI-Driven Financial Modeling and Forecasting

1. Greater opportunities for efficiency and speed

AI automates the complex processes of financial modeling, significantly reducing the time needed to generate AI-based forecasts. Businesses can, therefore, obtain insights in real-time, leading to faster decision-making without the delays associated with manual analysis.

2. Improved accuracy with data-driven insights

AI-driven models leverage ML algorithms to learn from historical data and continuously refine their predictions. This leads to greater forecasting accuracy, reducing the risk of errors caused by human bias or outdated methods.

3. Enhanced decision-making under scrutiny

AI excels at providing meaningful insights even in volatile or uncertain market conditions.

By incorporating various variables, from market trends to geopolitical events, AI-driven models enable businesses to make well-informed decisions under uncertainty, giving them a competitive edge in rapidly changing environments.

4. Customization and personalization

AI models can be tailored to the specific needs of a business or individual.

Whether adapting financial strategies to a business’s unique goals or creating personalized investment choices for clients, AI-driven systems offer flexible solutions that cater to diverse financial objectives, improving user satisfaction and ensuring accurate outcomes.

Boost Your Predictions with AI-Powered Financial Modeling!

Get Started nowOptimize Financial Decision-Making With AI

For SMEs and fintech companies, integrating AI can unlock personalized insights, optimize financial strategies, and automate critical but mundane tasks like fraud detection and credit scoring.

If you, too, want to tap into the potential of custom AI app development and change how you manage financial data and forecast future performance, you’re in for a treat.

Integrating AI into your financial processes allows you to future-proof your business, make smarter decisions, and drive sustainable growth.

Ready to take the next step?

Book a free consultation with Intuz today and receive a tailored roadmap for AI implementation in your financial operations. Don’t miss the opportunity to revolutionize your business with cutting-edge AI-powered solutions.